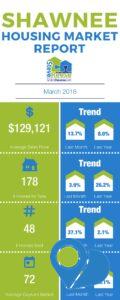

March housing market update shows rise in sales price

New residential real estate activity has been relatively slow in the first quarter of 2018, yet housing is proving its resiliency in a consistently improving economy. Some markets have had increases in signed contracts, but the vast majority of the nation continues to experience fewer closed sales and lower inventory compared to last year at this time. Despite there being fewer homes for sale, buyer demand has remained strong enough to keep prices on the rise, which should continue for the foreseeable future.

The Federal Reserve raised its key short-term interest rate by 0.25% in March, citing concerns about inflation. It is the sixth rate increase by the Fed since December 2015, and at least two more rate increases are expected this year. Borrowing money will be more expensive, particularly for home equity loans, credit cards and adjustable rate mortgages, but rising wages and a low national unemployment rate that has been at 4.1% for five months in a row would seem to indicate that we are prepared for this. And although mortgage rates have risen to their highest point in four years, they still remain quite low for most borrowers. Waiting to lock in your interest rate will cause you to afford less house!

If you would to discuss your particular property and how recent sales affect your home’s value, just call/text me at (405) 585-6580 or email Steve@SoldonShawnee.com. The data used in this blog post is from a research tool provided by MLSOK.