Protesting your property taxes: know your rights and take action!

Did you recently get a notice that your property taxes are increasing? As an experienced REALTOR® in Shawnee, Oklahoma, I can be your valuable resource in lowering your property tax bill. Modest increases are expected, and naturally, we want—and expect—our property values to increase.

Just this morning a past client let me know that with my help, their tax liability was reduced by more than 12%! Here’s how I can help you too:

Understanding Deadlines:

You have 30 days from the notice date to file a written protest with the county assessor. Missing this window could result in the proposed values becoming final.

Protest Preparation:

I assist in preparing a concise and effective broker’s price opinion that outlines all relevant facts about the market and your true estimated value. This ensures your protest is compelling and increases the chances of success.

Navigating Procedures:

Navigating Procedures:

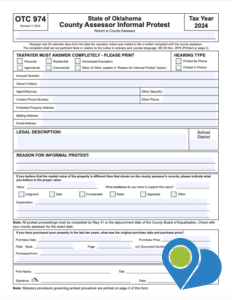

I guide you through the process of submitting the protest using the current version of the County Assessor Informal Protest Form 974, available on the Oklahoma Tax Commission website.

Expert Insights:

Drawing from my experience, I provide insights into common errors or discrepancies in property valuations, empowering you to make a strong case for tax reduction. If there are admitted errors by the assessor, corrections can be made at any time, regardless of the 30-day protest period.

But don’t delay! Contact me now to start the process of protesting your property taxes. Remember, the deadline is within 30 days of receiving the notice. Let’s work together to reduce your property tax liability and save you money. Call/text 405-585-6580 or email Hello@SoldonShawnee.com.