Considering making a move? Ask yourself these key questions.

If you’re tossing around the idea of snagging your dream home, you’re probably knee-deep in the real estate buzz. You know, soaking up info from all angles – news, social media, your go-to local real estate guru, and those heart-to-hearts with family and friends. And let’s not forget, the talk of the town: home prices and mortgage rates.

If you’re tossing around the idea of snagging your dream home, you’re probably knee-deep in the real estate buzz. You know, soaking up info from all angles – news, social media, your go-to local real estate guru, and those heart-to-hearts with family and friends. And let’s not forget, the talk of the town: home prices and mortgage rates.

Let’s break it down, keeping it real with the top two questions you gotta ask yourself as you navigate this exciting decision, spiced up with the essential details that cut through the noise.

1. Where Do I See Home Prices Going?

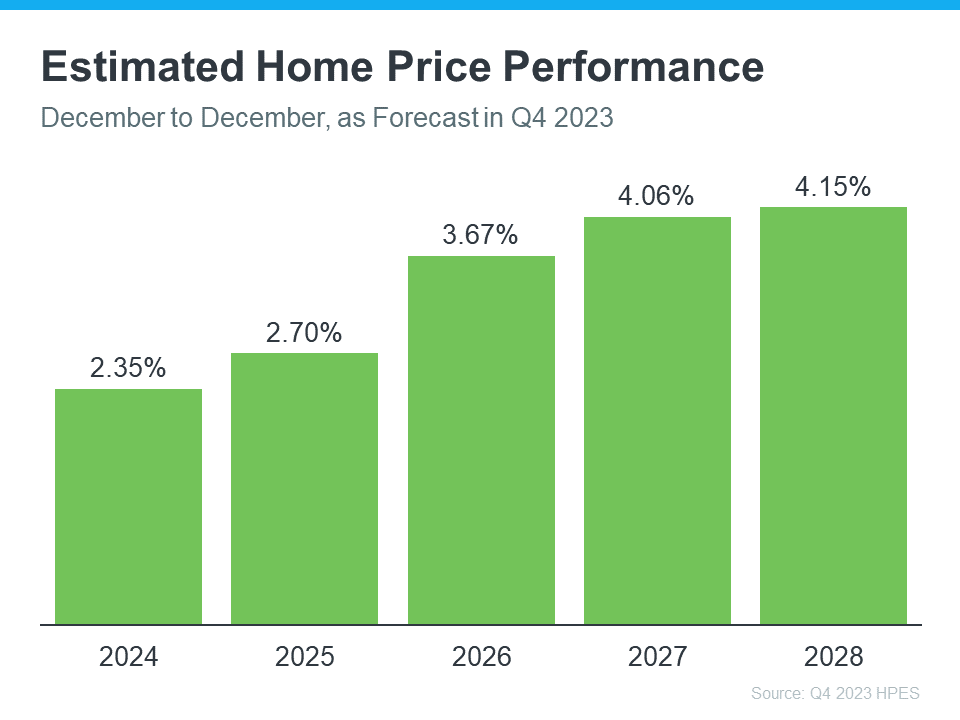

When it comes to forecasts on home prices, one reliable source stands out – the Home Price Expectations Survey from Fannie Mae. This survey gathers insights from over a hundred economists, real estate experts, and investment and market strategists.

Here’s the scoop: Recent data suggests experts predict home prices will keep climbing until at least 2028 (check out the graph below):

Now, why should this matter to you? While the rate of increase might not reach the peaks of recent years, the key takeaway is that these experts project prices to rise, not fall, for the next five years.

A moderate increase in home prices is positive news for both the market and, importantly, for you. Purchasing a home now means your property is likely to gain value, and you should accumulate home equity in the years to come. On the flip side, waiting could mean shelling out more money down the road, according to these forecasts.

2. Where Do I Think Mortgage Rates Are Heading?

Over the past year, mortgage rates experienced fluctuations in response to economic uncertainties and inflation. But there’s a silver lining for those eyeing the real estate market. As inflation chills, mortgage rates tend to fall in response, and recent weeks have seen exactly that. With the Federal Reserve signaling a pause in their Federal Funds Rate increases and the possibility of rate cuts in 2024, industry pros are increasingly optimistic about mortgage rates dropping.

Danielle Hale, Chief Economist at Realtor.com, breaks it down:

“. . . mortgage rates will continue to ease in 2024 as inflation improves and Fed rate cuts get closer. . . . a key factor in starting to provide affordability relief to homebuyers.”

An article from the National Association of REALTORS® (NAR) concurs:

“Mortgage rates likely have peaked and are now falling from their recent high of nearly 8%. . . . This likely will improve housing affordability and entice more home buyers to return to the market . . .”

While the future trajectory of mortgage rates is never certain, recent declines and the Federal Reserve’s decision signal a hopeful outlook. Although some volatility may persist, improving affordability is anticipated as rates continue to ease.

In Conclusion:

If homeownership is calling your name, understanding where home prices and mortgage rates are heading is key. No one’s got a magic eight-ball, but staying in the know empowers you to make a savvy move. Let’s chat so you can ride the wave of what’s happening – and trust me, it’s great news for you.

Ready to Dive In? Let’s Chat! The real estate game is buzzing, and your dream home is waiting. Don’t miss out on the action. Hit me up, and let’s make your homeownership dreams a reality! 🏡✨

2. Where Do I Think Mortgage Rates Are Heading?

Over the past year, mortgage rates spiked up in response to economic uncertainty, inflation, and more. But there’s an encouraging sign for the market and mortgage rates. Inflation is moderating, and here’s why this is such a big deal if you’re looking to buy a home.

When inflation cools, mortgage rates generally fall in response. That’s exactly what we’ve seen in recent weeks. And, now that the Federal Reserve has signaled they’re pausing their Federal Funds Rate increases and may even cut rates in 2024, experts are even more confident we’ll see mortgage rates come down.

Danielle Hale, Chief Economist at Realtor.com, explains:

“. . . mortgage rates will continue to ease in 2024 as inflation improves and Fed rate cuts get closer. . . . a key factor in starting to provide affordability relief to homebuyers.”

As an article from the National Association of Realtors (NAR) says:

“Mortgage rates likely have peaked and are now falling from their recent high of nearly 8%. . . . This likely will improve housing affordability and entice more home buyers to return to the market . . .”

No one can say with absolute certainty where mortgage rates will go from here. But the recent decline and the latest decision from the Federal Reserve to stop their rate increases, signals there’s hope on the horizon. While we may see some volatility here and there, affordability should improve as rates continue to ease.

Bottom Line

If you’re thinking about buying a home, you need to know what’s expected with home prices and mortgage rates. While no one can say for certain where they’ll go, making sure you have the latest information can help you make an informed decision. Let’s connect so you can stay up to date on what’s happening and why this is such good news for you.