What happens now that we have an accepted offer?

Congratulations!! You’re under contract! Once we’ve verbally accepted an offer, both parties will sign the contract. Once that happens, my transaction coordinator will send a copy of the executed contract and instructions to the title company to begin bringing the abstract up to date and be ready for title work.

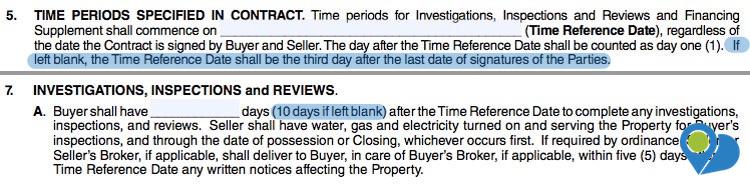

Unless otherwise specified in the contract, the buyer’s investigations period begins three calendar days after the last signature and lasts 10 days by default. See the excerpt below from Page 2 of 6 of the contract:

My transaction coordinator or I will let you know our specific timeline.

Meanwhile, the broker is required to be in receipt of the buyer’s earnest money within three business days. The earnest money deposit is essentially a good faith payment showing the buyer is serious about moving forward. The earnest money is held in trust and will be credited toward the buyer’s closing costs at closing. (I have another post that mentions expectations for keeping earnest money if the contract fails during the investigations or appraisal period.)

I prefer for either one of the brokers to hold the deposit in a trust account simply because we have a much more streamlined process for releasing it (compared to a title company) should a dispute arise between the buyer and seller and the buyer asks for the earnest money to be returned. If neither has a trust account, then we have no choice but to deposit it with the title company.

Next we will change the property to PENDING in the MLS, cancel any future showing requests and cancel any upcoming open houses. We are then officially in the investigations time period (see your contract for the exact number of days).

Although we try to avoid obstacles, many things can happen during a transaction. We will do everything we can to avoid these issues, and if they do happen, we will help you overcome them.

- Buyer does not turn in the earnest money deposit

- Buyer does not complete the loan application on time

- Lender does not provide written conditional loan approval on time

- Buyer does not meet contractual deadlines

- Buyer submits a lengthy or unreasonable list of requests in their Notice of Treatments, Repairs and Replacements (TRR)

- Buyer cancels because of information found in their investigations or inspections

- Lender orders appraisal late

- Appraisal does not come in at value or has required repairs

- Difficulty obtaining HOA documents during investigations period

- Buyer has a change in job, finances or FICO score during escrow

- Buyer cancels for a reason you do not understand

- Delays in buyer completing paperwork

- Part-time agent on the other side is not fully engaged in the sale

- Unforeseen damage or change to the property condition during escrow

- Sale of buyer’s property falls through

- Buyer’s insurance company requires an inspection of the property (usually roof)

- Buyer opens new credit account prior to closing

- Title does not receive funds in order to complete the closing

- Transaction does not close on time as expected

I understand that obstacles may be upsetting, and I want you to know that navigating through these situations is where my expertise shines. I’ve been through this before, and problem-solving is definitely my superpower in real estate. Rest assured, I’ve got a plan in place to tackle this head-on, and I’m here with you every step of the way. We’ll work together to find the best solution and keep things moving smoothly. Your peace of mind is my top priority, and I’m committed to making this process as seamless as possible for you.

Questions? Call me at (405) 585-6580 or email Steve@Soldonshawnee.com.

<< STEP 12: We received an offer. What does it mean? >> STEP 14: Home inspections